Below is a copy of an article about what the experts think is going to happen in the housing market. They are definitely giving good advice, but mine is always better. Why you ask? Because I've got the local market knowledge, I've been at this for almost two decades. I've survived where others have failed when the market is turned upside down & sideways. Call me today, well, after you read the below article, about what's happening where you live and/or where you want to live. I'm happy to share my knowledge and experience with each and every one of you. My direct number you can text/call is (661) 313-5470. Wishing you all the best on this very last day of 2019!

------------------------------

Expert Insights on the 2020 Housing Market

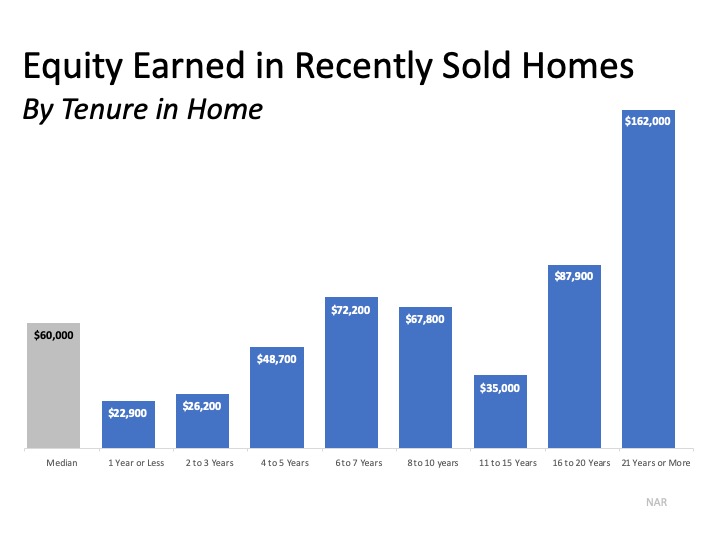

When closing out another year, it’s normal to wonder what’s ahead for the housing market. Though there will be future inventory issues, we expect interest rates to stay low and appreciation to continue.

Here’s what three experts are saying we’ll likely see in 2020:

“I think the biggest surprise from the forecast is how long the market is staying in this low inventory environment, especially as Millennials are in a major home-buying phase…sellers will contend with flattening price growth and slowing activity with existing home sales down 1.8%. Nationwide you can look to flat home prices with an increase of less than 1%.”

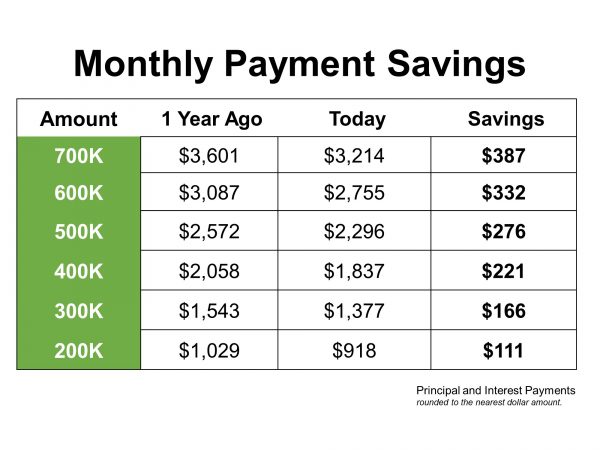

"Interest rates will, on average, remain lower…These lower rates will in turn support both purchase and refinance origination volume in 2020."

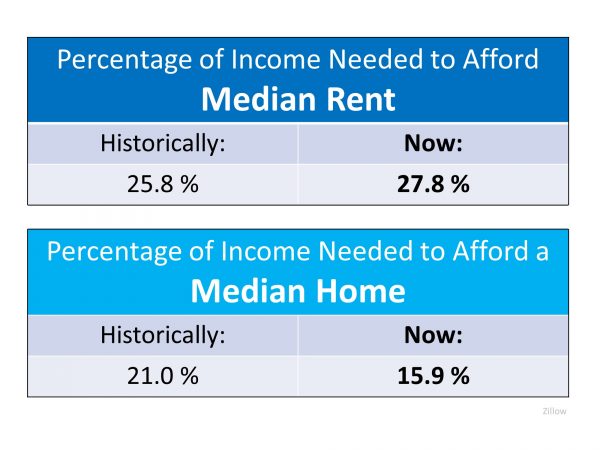

“If current trends hold, then slower means healthier and smaller means more affordable. Yes, we expect a slower market than we’ve become accustomed to the last few years…consumers will continue to absorb available inventory and the market will remain competitive in much of the country.”

As we can see, we’re still going to have a healthy market. It is forecasted to be a more moderate (or normal) market than the last few years, but strong enough for Americans to continue to believe in homeownership and to capitalize on the opportunities that come with low interest rates.

Bottom Line

If you’re wondering what’s happening in our local market, let’s get together today.