A licensed Realtor is always allowed to help you when you purchase a new construction home. Sometimes, however, a buyer will use the sales associate hired by the builder to complete the purchase of that home. Is what it is, hopefully it went well.

So, 5-7 years later, you're ready to sell that home.....but, you don't know a Realtor because you didn't meet one when you purchased it that can advise you on the process to sell.

You likely have friends that can be a great resource for you when the time comes.

If you don't, read on.....what you need to think about when hiring a Realtor to sell your home.

1) How much does it cost to sell a home? It's generally based upon the sale price. Anticipate between 7 & 8 percent of the sale price to cover escrow, title, loan pay-offs, pro-rations of property taxes & HOA dues, realtor, and more. Want a real number? I provide that to my clients.

2) How do I determine how much my home is worth and what I should list it for? By now you've been peeking on Realtor websites that give you estimates on value. An experienced Realtor will be able to determine the value, then you decide which sales strategy works best for your personal situation. I have 3 different planned strategies.

3) What about marketing? First we need to discuss what you are willing to do to your home to get it ready for marketing. Then, my team comes in and takes care of the rest with photography, drone work, flyers, networking, and more.

4) Who handles the people that want to see your home? Me, always me. We work on a comfortable arrangement for you and your family. Ask me about why you need to make it as easy as possible for a buyer to see your home.

5) What if someone offers us too little? My job is to negotiate the best possible price for you. And, I do it well. My list to sale ratio is extremely high.....feel free to ask any agent what theirs is....and pleasantly ask for proof when they tell you. It's very easy to calculate.

6) What about all the paperwork we hear about? There is a lot, not going to kid you. Your Realtor should be guiding you through every step of it. If they are going to pass you off to an assistant to handle that....look for someone else. The first time you sell a home is a new experience, you need to understand exactly what you are doing.

7) What if we want to sell one home & move into another home at the same time? Ahhh, that's for another post....keep reading my blog, I'll touch on that soon. Suffice it to say, I love challenges, keeps my world exciting.

If you're thinking about selling your home, whether you bought as new construction or not...happy to come out and meet you at your home to discuss my strategies, fees, marketing plan and getting your home sold. All you have to do is ask.

This blog is set up for clients, associates, friends, relatives, and myself, to discuss real estate thoughts, questions and get some answers.

Friday, May 31, 2019

Tuesday, May 28, 2019

Properly Pricing Your Home Is So Important!

Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

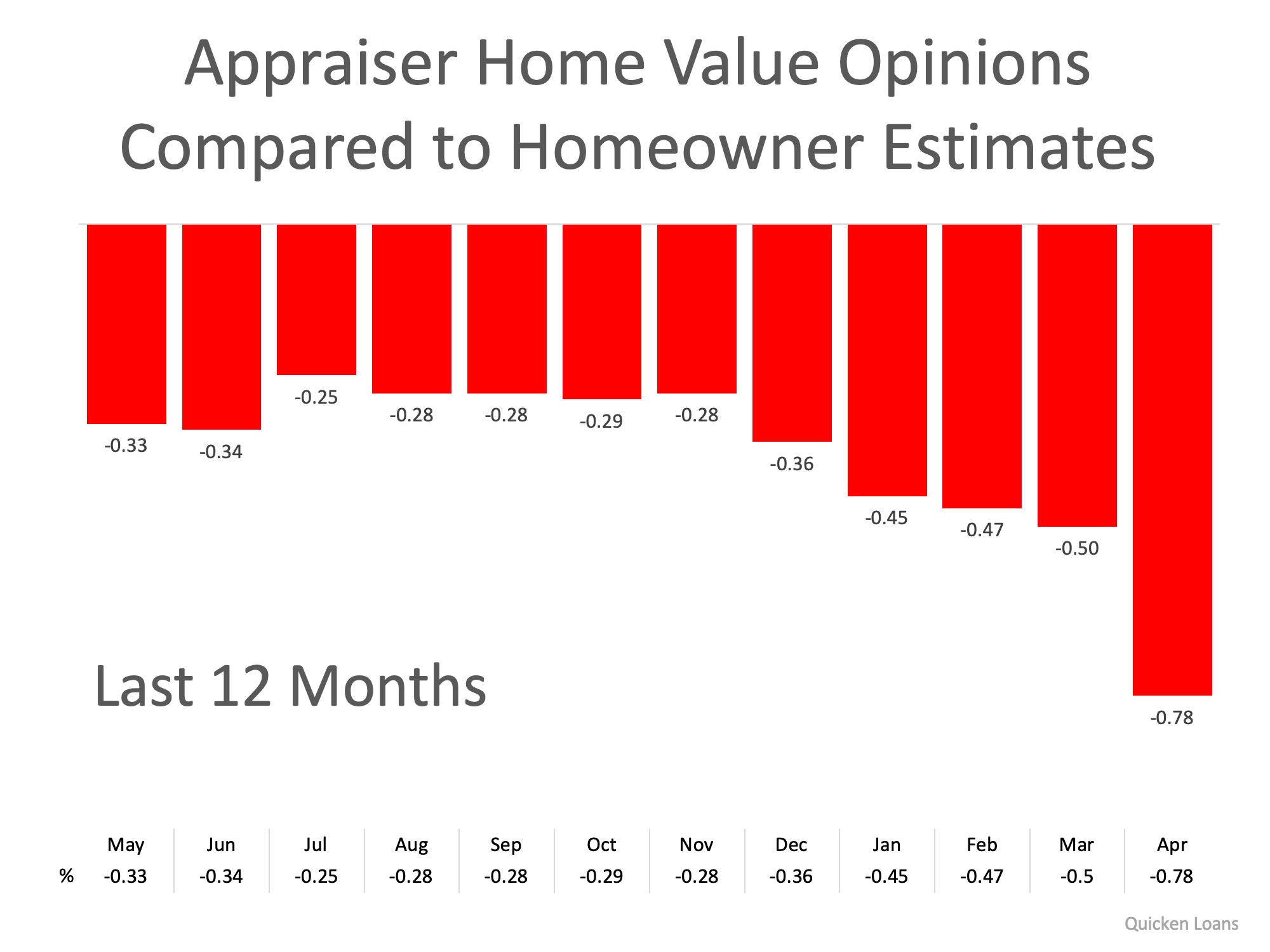

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

Friday, May 24, 2019

Some Great Exterior Projects To Ramp Up Your Curb Appeal....Whether You're Selling Your Home or Not!

I saw this article on Houzz today, even though it landed in my email a few days back. New escrows take precedence over fun reading!

One of the things we talk about is the curb appeal of your home. It truly is the very first thing people see. Most will plant a few flowers, clean up the driveway, maybe pressure wash the exterior.

But, take a gander at the Houzz article here:

One of the things we talk about is the curb appeal of your home. It truly is the very first thing people see. Most will plant a few flowers, clean up the driveway, maybe pressure wash the exterior.

But, take a gander at the Houzz article here:

The walk way up to your home needs to invite you inside ....for sure!

New garage doors can make a huge impact.

A bigger negative impact are ugly old doors.

This may be a bit selfish as a Realtor,

but bold address signs are very cool when trying to find a home to show my clients!

There are seven more ideas in the article. Keep in mind if you live in a community with an HOA, check with them first.

Enjoy the ideas.....which one do you like best for your home? Oh, and of course, if you want my humble (not really, I'm not meek) opinion...just holler!

Tuesday, May 21, 2019

Home Sales Activity in Santa Clarita May 21, 2019

I hope that the information I share keeps you current and knowledgeable on Real Estate!

Today is about home sales in our lovely little town. Acton to the East, Stevenson Ranch to the West, Castaic to the North, and Newhall to the South. Plus, of course, all our sweet little hoods in between!

Today is about home sales in our lovely little town. Acton to the East, Stevenson Ranch to the West, Castaic to the North, and Newhall to the South. Plus, of course, all our sweet little hoods in between!

Currently we actually have 720 homes for sale! WOWZA!

Under contract/In Escrow you wonder? 500.

Yep, waiting for 500 homes to close escrow.

Sold in the last 30 days? A lovely healthy number of 374.

So, that means, we still are low, as we only have about a 2 month supply. I can see some homes staying on the market a tad longer. If you are a Seller, it now really requires appropriate pricing. If you are a Buyer, it still may be a multiple offer situation on the best of the best.

If you have any questions about anything related to your Home or Real Estate.....anywhere in the USA, contact me first. No matter what, contact me first. I'd hate for you to make a slight error because you didn't learn something correctly from me.

Friday, May 17, 2019

Title Insurance & A Preliminary Title Report ~ What Are They?

In short terms I tell clients the title insurance makes it so 'Johnny Joe' can't claim he owns your property 3 years after escrow closes. That's the brief description.

But, it actually can be so much more than that. Read on the learn something today:

Whenever my seller(s) sign a listing agreement, one of the first things I do, is order a preliminary title report.

The prelim is an intense search on the property in question and the sellers of same property.

When it arrives I read it, yes, I truly read it. I'm looking for liens, weird judgements, odd 'exceptions' on the report.

Why you ask? Because nothing can hurt a sale more than finding something 'off' on the prelim that needs time to resolve.

Say you find a lien against the seller they thought was charged off back in the day? Well, we can't close escrow with a clear title unless that lien is paid. Because, if that lien isn't paid, buyers don't have a clear title. And, without a clear title, there is no title insurance without that lien still be attached to the property.

But, it actually can be so much more than that. Read on the learn something today:

Whenever my seller(s) sign a listing agreement, one of the first things I do, is order a preliminary title report.

The prelim is an intense search on the property in question and the sellers of same property.

When it arrives I read it, yes, I truly read it. I'm looking for liens, weird judgements, odd 'exceptions' on the report.

Why you ask? Because nothing can hurt a sale more than finding something 'off' on the prelim that needs time to resolve.

Say you find a lien against the seller they thought was charged off back in the day? Well, we can't close escrow with a clear title unless that lien is paid. Because, if that lien isn't paid, buyers don't have a clear title. And, without a clear title, there is no title insurance without that lien still be attached to the property.

There is what is considered a 'cloud' on the title.

And, trust me, you don't want that stuff raining on your parade!

What we frequently find are old CC & R's that run with the land. Mineral rights, stuff like that. Of course, we find the sellers mortgage.

I've got one now that has a couple issues that seller thought was cleared years & years ago! I've found old mortgages that are just errors. I found a child support judgement. An HOA lien against a seller years ago as well. Tax liens, mechanics liens. You think it, I've seen it.

And, to get clear title insurance & close escrow, we frequently need to clear exceptions noted on the prelim.

Curious about any old stuff you think just may be attached to your home? Just ask, I'll help you find out.

Tuesday, May 14, 2019

Stop Scrolling & Start Buying.....I'm Here to Help

New Research Shows Housing Is Affordable For First-Time Buyers

Home prices have been on the rise for the last seven years, leading many housing market analysts to conclude that first-time homebuyers are being shut out of the market due to affordability concerns.

The National Association of Realtors (NAR) reports on the percentage of First-Time Home Buyers (FTHB) on a monthly and yearly basis. Their latest reportshows that FTHB’s made up 33% of buyers in March, which matches their reported share in 2018.

NAR uses survey data from their members to come up with this statistic, so their results do not include every transaction completed. Rather, they only the transactions reported by members who complete the survey.

The other entity that reports on FTHB share is the American Enterprise Institute (AEI). The AEI uses data from mortgage applications that define an FTHB as “any borrower who did not have a mortgage for the preceding three years.”

This means the AEI measurement also includes former homeowners who transitioned out of a home they previously owned and re-entered the market after at least 3 years. The latest FTHB share data from AEI shows that first-time buyers made up 57.5% of all mortgages in August 2018. NAR’s data shows a 31% share for the same time period.

New research from the New York Federal Reserve shows that these traditional reports on FTHB share have been unable to give an accurate depiction of this group’s involvement in the market.

The NY Fed was able to take consumer credit data and identify when a mortgage payment entered a consumer’s credit report to determine when a first-time home purchase was made. Using this data, they were able to show that AEI’s reported FTHB share was consistently 10% higher. The NAR reports were right on par with their findings until 2010, when NAR’s share dropped to the 11% gap seen today.

So, what does this all mean?

First-time home buyers have not disappeared from the market as many analysts had believed. Buying a home is very much a part of the American Dream for younger generations, just like it had been for their parents and grandparents.

This also means that rising prices have not scared buyers away from the market. Many first-time buyers are making sacrifices to save their down payment and make their dream a reality.

Bottom Line

If you are one of the many renters who is scrolling through listings on your phone every night dreaming of buying your own home, there are opportunities in every market to make that dream a reality!

Friday, May 3, 2019

For My Peeps & American Cancer Society; Relay For Life SCV

I made a goal for 2019. I've shared the possibility with everyone I know. There are two special non-profit organizations that I want to help even more this year than the last few. You may tell me your own though, not just these two are 'eligible' for my donation gift.

One gal is so special to my heart. Well, actually her whole family is. She and her husband have one child...a blessing. Now, another is on the way. Truly never knew for sure if children would be in their future.

She is a cancer survivor. The most animated, positive, loving person I think I've honestly ever met. Notice animated was the first adjective! She is an absolute delight. She is definitely one helluva survivor.

I helped her buy two homes in the past. I just helped her sell one to a dear friend. And, we opened escrow on the other home with an all cash buyer this week.

Needless to say, we're heading out tomorrow to start house hunting for a replacement home for their growing family.

Purpose of this post though? Today, I donated $243.00 to the American Cancer Society, SCV Relay For Life. Why? Because that's a commitment I made & she was the first to be part of that commitment.

If you are thinking about Selling or Buying a home with me, just ask about this program, why I do it, and let me know what's important to you.

One gal is so special to my heart. Well, actually her whole family is. She and her husband have one child...a blessing. Now, another is on the way. Truly never knew for sure if children would be in their future.

She is a cancer survivor. The most animated, positive, loving person I think I've honestly ever met. Notice animated was the first adjective! She is an absolute delight. She is definitely one helluva survivor.

I helped her buy two homes in the past. I just helped her sell one to a dear friend. And, we opened escrow on the other home with an all cash buyer this week.

Needless to say, we're heading out tomorrow to start house hunting for a replacement home for their growing family.

Purpose of this post though? Today, I donated $243.00 to the American Cancer Society, SCV Relay For Life. Why? Because that's a commitment I made & she was the first to be part of that commitment.

If you are thinking about Selling or Buying a home with me, just ask about this program, why I do it, and let me know what's important to you.

Subscribe to:

Posts (Atom)