This blog is set up for clients, associates, friends, relatives, and myself, to discuss real estate thoughts, questions and get some answers.

Tuesday, December 29, 2020

Winter Cleaning VS. Spring Cleaning?

Wednesday, December 23, 2020

Super Important When You're A Buyer In Escrow!

The Do’s and Don’ts after Applying for a Mortgage

Once you’ve found the right home and applied for a mortgage, there are some key things to keep in mind before you close. You're undoubtedly excited about the opportunity to decorate your new place, but before you make any large purchases, move your money around, or make any major life changes, consult your lender – someone who is qualified to tell you how your financial decisions may impact your home loan.

Below is a list of things you shouldn’t do after applying for a mortgage. They’re all important to know – or simply just good reminders – for the process.

1. Don’t Deposit Cash into Your Bank Accounts Before Speaking with Your Bank or Lender. Lenders need to source your money, and cash is not easily traceable. Before you deposit any amount of cash into your accounts, discuss the proper way to document your transactions with your loan officer.

2. Don’t Make Any Large Purchases Like a New Car or Furniture for Your New Home. New debt comes with new monthly obligations. New obligations create new qualifications. People with new debt have higher debt-to-income ratios. Higher ratios make for riskier loans, and then sometimes qualified borrowers no longer qualify.

3. Don’t Co-Sign Other Loans for Anyone. When you co-sign, you’re obligated. With that obligation comes higher ratios as well. Even if you promise you won’t be the one making the payments, your lender will have to count the payments against you.

4. Don’t Change Bank Accounts. Remember, lenders need to source and track your assets. That task is significantly easier when there’s consistency among your accounts. Before you transfer any money, speak with your loan officer.

5. Don’t Apply for New Credit. It doesn’t matter whether it’s a new credit card or a new car. When you have your credit report run by organizations in multiple financial channels (mortgage, credit card, auto, etc.), your FICO® score will be impacted. Lower credit scores can determine your interest rate and maybe even your eligibility for approval.

6. Don’t Close Any Credit Accounts. Many buyers believe having less available credit makes them less risky and more likely to be approved. Wrong. A major component of your score is your length and depth of credit history (as opposed to just your payment history) and your total usage of credit as a percentage of available credit. Closing accounts has a negative impact on both of those determinants of your score.

Bottom Line

Any blip in income, assets, or credit should be reviewed and executed in a way that ensures your home loan can still be approved. If your job or employment status has changed recently, share that with your lender as well. The best plan is to fully disclose and discuss your intentions with your loan officer before you do anything financial in nature.

Friday, December 18, 2020

Santa Clarita Home Sales Activity - One Week Before Christmas 2020

Well, needless to say our inventory is shrinking. It's, quite honestly, HALF of what we had this time last year.

Who would have thought a pandemic would create such a housing frenzy.

If you've been reading my blogs, watching my YouTubes, following me on SM, then you know I consider SCV to include Acton to the East, Castaic to the North, Stevenson Ranch to the West, and Newhall to the South plus all the little communities in between.

As of 1 pm today we have 245, yup, you saw that right, 2....4....5 homes available for sale. That includes Single Family Residences, Condos, Townhouses.

Tuesday, December 15, 2020

Considering a Forbearance? Read On!

5 Steps to Follow When Applying for Forbearance

If you’re currently feeling the stress of affording your mortgage payment, or if you know someone who is, there’s still time to get help. For homeowners experiencing financial hardship this year, the CARES Act provides mortgage payment deferral options, creating much-needed relief in these challenging times.

It’s important, however, to understand how forbearance works. It’s not automatic. You need to take action now and apply for the program before these options expire.

A study by the Urban Institute determined:

“Approximately 400,000 homeowners who became delinquent after the pandemic began have forgone forbearance and become delinquent. These borrowers may not know they are eligible for forbearance.”

Thankfully, there’s still time to apply for forbearance, even if you’re just learning about it now. Doing so may be the game-changer you need to stay in your home, just when you need it most. Mike Fratantoni, Senior Vice President and Chief Economist at the Mortgage Bankers Association (MBA), explained:

“The increase in new forbearance requests may be the result of additional outreach to homeowners who had previously not taken advantage of forbearance opportunities.”

If you need to apply for forbearance but aren’t sure how to begin the process, the Consumer Financial Protection Bureau (CFPB) published 5 steps to follow when requesting mortgage forbearance:

1. Find the contact information for your servicer

Look at your mortgage statement to find the phone number for your servicer (the company you send your mortgage payment to every month). The Consumer Financial Protection Bureau encourages you to use the number on your statement to avoid scams.

2. Call your servicer

Explain your situation so your servicer can determine your best course of action. Be sure to ask any questions you have about the process.

3. Ask if you’re eligible for protection under the CARES Act

The CARES Act protects homeowners with federally backed loans (FHA, VA, USDA, Fannie Mae, and Freddie Mac). In addition, some private servicers are also providing forbearance programs.

4. Ask what happens when your forbearance period ends

Depending on the plan available to you, there are different options you may be able to consider. Your servicer will help you get a better understanding of what’s available.

The CFPB also recommends asking questions like:

- What happens to the payments I miss?

- What are my repayment options?

- When will repayment be due?

- Are there any fees?

5. Ask your servicer to provide the agreement in writing

A written agreement allows you to see exactly what type of program you’re agreeing to. It also helps you make sure it matches what you discuss with your provider over the phone.

Bottom Line

Help is out there for homeowners in need, but it’s important to apply now while this benefit is still available. The Consumer Financial Protection Bureau says: don’t wait, forbearance is not automatic. It must be requested. Reach out to your mortgage provider today so you can get the assistance you need to protect the hard-earned investment you’ve made in your home.

Friday, December 11, 2020

Lack of Common Courtesy in Real Estate

A story of the week, and a subject matter I've touched on previously....

Working with a couple of buyers. We've written offers on a few properties. It's a challenging market to say the least but they've stepped up to the plate. Written offers quickly, removed appraisal contingencies, patiently waited to hear back from the listing agents. Me? I'm not quite as patient.

But, that's not even the real story here.

We wrote on a property that was under-priced and listed by an agent that is from out of the area. Needless to say, per agent, they received 15 offers. Ours was originally written 25k over list price, then we bumped up another 10k, removed our appraisal contingency, shortened up inspection period ridiculously, and tightened up loan contingency as well.

These days it's a text, an email, not so often a phone call. But, I text agents to alert them that I'm sending them an email if it's offer related and ask for 'Confirmation of Receipt'...always. If I don't hear back, I make a phone call, leave a message.

This particular agent was hot in response when he first put it on the market in the Coming Soon category. He was pretty good when it went active, he was sorta okay when I sent the offer, and just okay when I sent back our final response to their seller multiple counter offer.

After emails and texts I would finally get a response that seller was making a decision today and ours was one of the top ones. Next day, same thing, seller was making a decision today, it "was hard as there were 5 really good offers"....my clients being one of them.

Next day....and, since then, it's been silence. No response to texts/emails, nada. Then, as we expected, the property showed as under contract in the MLS.

Not a nice way to find out your buyers offer wasn't selected. And, while in Santa Clarita most agents are pretty good about treating people with respect....that other crowd?

Friday, December 4, 2020

The Bachelorette & Being A Realtor? What?

A couple years ago I joined a women's group for fun. I started by going to a Bachelor watch party! I used to watch it years & years ago, stopped as it's so silly.

I became foolishly addicted to it again! And, now I watch the Bachelor AND the Bachelorette! Sheesh!

So, what does that have to do with being a Realtor?

I took a listing 14 days ago. It had been on the market many times with previous agents. I presented to the sellers my ideas of how it should be marketed, price it should be listed at, and the things I would do to get it sold.

I had my photographer extraordinaire take day, twilight, & drone still shots. And, I had him do a video highlighting the home & property. It still was the same home, no wide angle lenses or photo-shopping extreme going on there. But it also showed the property, the hills, the road in. It truly showed the home in it's real, yet best, light.

I prepared an additional document about the home that was put in the MLS. I did the description for the home with a little tweaking from the Seller.

And, before anyone was allowed to view.....did the buyer know about the dirt road, had they watched the video, and were they willing to put on tennis shoes and actually walk the property with me as their guide? Honestly? If they weren't willing to hike around, it wasn't the home for them.

So, I don't know how many times, I lost count, I was tour guide for the home in Tapia Canyon with the family of deer. A one hour tour. The hills, the views, the meandering paths. I enjoyed it, I got tired for sure, but it was tons of fun for me as well.

Suffice it to say, we got 3 very strong offers in and have just selected the winning buyer last night, significantly over list price.

Again, what does this have to do with that silly rose petals and ring show?

Tuesday, December 1, 2020

Every Buyer Has Heard Alllllll Of These From Me!

5 Tips for Homebuyers Who Want to Make a Competitive Offer

Today’s real estate market has high buyer interest and low housing inventory. With so many buyers competing for a limited number of homes, it’s more important than ever to know the ins and outs of making a confident and competitive offer. Here are five keys to success for this important stage in the homebuying process.

1. Listen to Your Real Estate Agent

A recent article from Freddie Mac offers guidance on making an offer on a home in today’s market. Right off the bat, it points out how emotional this can be for buyers and why trusted professionals can help you stay focused on the most important things:

“Remember to let your homebuying team guide you on your journey, not your emotions. Their support and expertise will keep you from compromising on your must-haves and future financial stability.”

Your real estate professional should be your primary source for answers to the questions you have when you’re ready to make an offer.

2. Understand Your Finances

Having a complete understanding of your budget and how much house you can afford is essential. The best way to know this is to reach out to your lender to get pre-approved for a loan early in the homebuying process. Only 44% of today’s prospective homebuyers are planning to apply for pre-approval, so be sure to take this step so you stand out from the crowd. It shows sellers you’re a serious, qualified buyer and can give you a competitive edge if you enter a bidding war.

3. Be Ready to Move Quickly

According to the Realtors Confidence Index, published monthly by the National Association of Realtors (NAR), the average property being sold today is receiving more than three offers and is only on the market for a few weeks. These are both results of today’s competitive market, showing how important it is to stay agile and vigilant in your search. As soon as you find the right home for your needs, be prepared to work with your agent to submit an offer as quickly as possible.

4. Make a Fair Offer

It’s only natural to want the best deal you can get on a home. However, Freddie Mac also warns that submitting an offer that’s too low can lead sellers to doubt how serious you are as a buyer. Don’t submit an offer that will be tossed out as soon as it’s received. The expertise your agent brings to this part of the process will help you stay competitive:

“Your agent will work with you to make an informed offer based on the market value of the home, the condition of the home and recent home sale prices in the area.”

5. Be a Flexible Negotiator

After submitting an offer, the seller may accept it, reject it, or counter it with their own changes. In a competitive market, it’s important to stay nimble throughout the negotiation process. Your position can be strengthened with an offer that includes flexible move-in dates, a higher price, or minimal contingencies (conditions you set that the seller must meet for the purchase to be finalized). There are, however, certain contingencies you don’t want to forego. Freddie Mac explains:

“Resist the temptation to waive the inspection contingency, especially in a hot market or if the home is being sold ‘as-is’, which means the seller won’t pay for repairs. Without an inspection contingency, you could be stuck with a contract on a house you can’t afford to fix.”

Bottom Line

Today’s competitive market makes it more important than ever to make a strong offer on a home, and a trusted expert can help you rise to the top along the way.

Tuesday, November 24, 2020

Wild Market, Should You Buy A Home Today?

Is Buying a Home Today a Good Financial Move?

There’s no doubt 2020 has been a challenging year. A global pandemic coupled with an economic recession has caused heartache for many. However, it has also prompted more Americans to reconsider the meaning of “home.” This quest for a place better equipped to fulfill our needs, along with record-low mortgage rates, has skyrocketed the demand for home purchases.

This increase in demand, on top of the severe shortage of homes for sale, has also caused more bidding wars and thus has home prices appreciating rather dramatically. Some, therefore, have become cautious about buying a home right now.

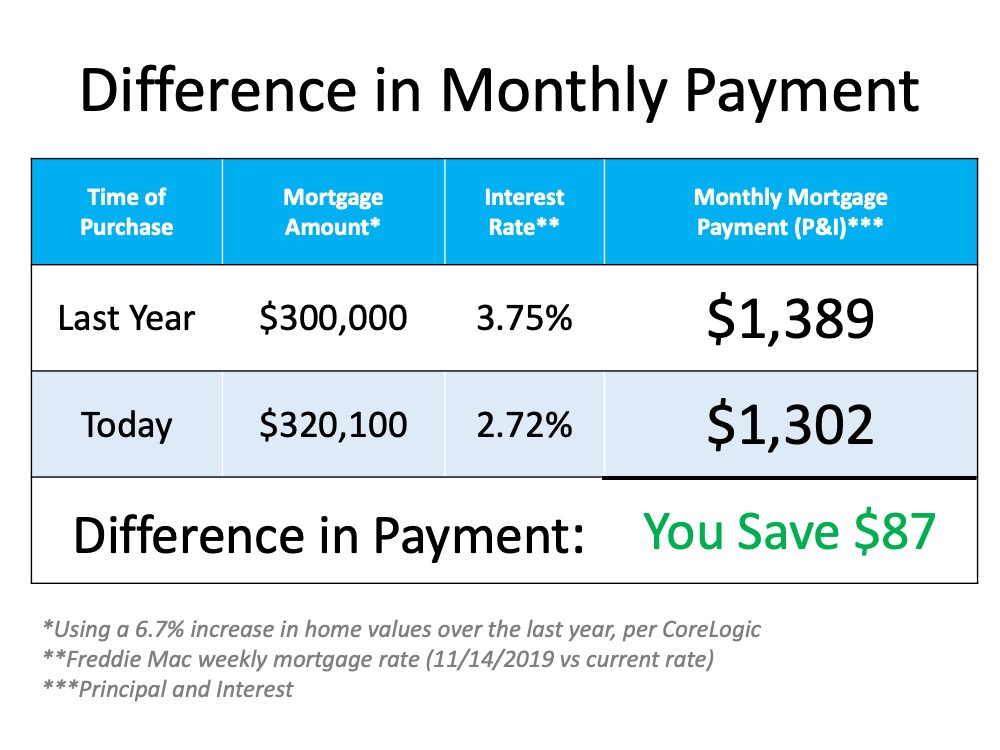

The truth of the matter is, even though homes have appreciated by a whopping 6.7% over the last twelve months, the cost to buy a home has actually dropped. This is largely due to mortgage rates falling by a full percentage point.

Let’s take a look at the monthly mortgage payment on a $300,000 house one year ago, and then compare it with that same home today, after it has appreciated by 6.7% to $320,100: Compared to this time last year, you’ll actually save $87 dollars a month by purchasing that home today, which equates to over one thousand dollars a year.

Compared to this time last year, you’ll actually save $87 dollars a month by purchasing that home today, which equates to over one thousand dollars a year.

But isn’t the economy still in a recession?

Yes, it is. That, however, may make it the perfect time to buy your first home or move up to a larger one. Tom Gil, a Harvard trained negotiator and real estate investor, recently explained:

“When volatile assets are facing recessions, hard assets, such as gold and real estate, thrive. Historically speaking, residential real estate has done better compared to other markets during and after recessions.”

That thought is substantiated by the fact that homeowners have 40 times the net worth of renters. Odeta Kushi, Deputy Chief Economist for First American Financial Corporation, recently said:

“Despite the risk of volatility in the housing market, numerous studies have demonstrated that homeownership leads to greater wealth accumulation when compared with renting. Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments, which become a form of forced savings for homeowners.”

Bottom Line

With home prices still increasing and mortgage rates perhaps poised to begin rising as well, buying your first home, or moving up to a home that better fits your current needs, likely makes a ton of sense.

Friday, November 13, 2020

An Email I Sure Didn't Want to Get

I've been working with a couple for a little bit now. We went to see something outside the box yesterday. We drove in separate cars. We wore masks and gloves the entire time we were in the home. I take my gloves & mask off inside out and leave any germs tucked inside those little buggers and throw away when I get home.

After that appointment, I went over to see another client. Sanitized my hands as I was getting out of my car. Put another mask on. They were wearing masks as well.

Later last night I received an email from the listing agent from the outside the box home I showed earlier in the day. This was from her seller.

"I want to let you know that I found out today that a person who I had contact with recently tested positive for Covid-19. My last contact with that person was 37 hours ago. That person was staying at my house for 6 days prior to leaving at 3:30am Wednesday morning."

So after a few, 'Oh crap' comments, I forwarded the email to the buyers that came in the house, called them as well to alert them. Called my office manager. And, then forwarded the email to the client I saw afterwards and called her as well. She's a nurse and works testing Covid all day long. I said a few more Oh Craps to her and she put me at ease. She reminded me that I did everything right, that I wasn't in direct contact with the Covid person (the house was vacant when we went in), and that per the CDC I would have had to be in direct contact with that person, less than 6ft away and/or have touched something that person touched in the last 15 minutes to be considered exposed.

So, the purpose of this post? To remind you to be vigilant. To follow the rules when viewing or showing homes. To be very careful with yourself and the people you are responsible for. I can't control everyone, but I can control the clients I work with & they are definitely following the rules.

Tuesday, November 10, 2020

That 15K Biden is Suggesting May, or May Not, Be A Great Thing.....

Read an article from one of my housing drips and I'm just copying and pasting here so you know it's not just my opinion but from the National Association of Realtors.

It does, however, make complete sense to me.

"The news over the weekend that former Vice President Joe Biden is now president-elect elicited positive reactions from several real estate leaders who saw the upside for the housing market.

Biden’s housing proposals include a $15,000 first-time homebuyer tax credit and he will focus on fair housing and affordable housing issues. He is also likely to appoint a new head of the Federal Housing Finance Agency.

The National Association of Realtors Chief Economist Lawrence Yun told HousingWire that the $15,000 tax credit is good news since it can go a long way in terms of helping first-time homebuyers and minority households. However, that’s only one part of the solution.

“But that’s not the full story, the full story is that stimulating the demand just by itself I think is insufficient,” Yun said. “Right now the housing market is facing a significant housing shortage. So if we add further stimulus to the demand without addressing the supply… it will simply bump up the prices even higher.”

Yun said that the ongoing housing supply shortage is getting worse and not enough homes are being built to face the demand.

“We simply have not been building a sufficient amount of homes,” Yun said. “We also need to address the supply side, how do we bring more supply? It’s going to take some time, but just adding more fuel to the housing demand without addressing the supply would just simply mean that home prices could accelerate much higher and partly negating some of the benefits of the $15,000 tax credit.”"

Back to me now. I do love tax credits for first time buyers, it's helped many of my clients in the past. But, I am not a fan of it until we get more homes on the market, because, like Yun says.....we'll just drive up prices more with more demand if there is 15k in someones pocket to buy. We Need More Inventory.

Friday, October 30, 2020

I Was Just Talking With A Dear Friend About This on Monday!

Should I Renovate My House Before I Sell It?

![Should I Renovate My House Before I Sell It? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/10/29115125/20201030-MEM-1046x1807.png)

Some Highlights

- In today’s hyper-competitive market, buyers are often willing to overlook cosmetic or minor repair needs if it means snagging a home in their price range.

- With so few houses available for sale today, you may be able to skip the bigger renovations before you sell and cash in on the current demand for your house.

- If you’re ready to move, let’s connect to determine your best next steps in this sellers’ market.

Tuesday, October 27, 2020

A Couple Reminders About Home Equity

Two Important Impacts of Home Equity

Equity continues to rise, helping American homeowners secure a much more stable financial future. According to the most recent data from CoreLogic, the average homeowner gained $9,800 in equity over the past year. In addition, experts project 2020 home prices to continue rising. With prices going up, equity gains will also keep accelerating. Black Knight just reported:

“The annual percent change in the overall median existing single-family-home price has skyrocketed in the past several months, with recent numbers at three to five times higher than rates seen in the past several years.”

Jeff Tucker, Senior Economist at Zillow, just qualified recent price increases as “jaw-dropping” and “within a hair's breadth of double-digit year-over-year appreciation.”

Knowing equity will help enable many homeowners to better survive the economic distress caused by the ongoing pandemic, it’s important to break down two key homeowner benefits of increasing equity.

1. Equity Increases a Homeowner’s Options to Buy a New Home

Aside from the financial damage of the last seven months, there has also been a tremendous emotional toll on many people. Shelter-in-place mandates, quarantine requirements, and virtual schooling have all made us re-evaluate the must-have requirements a home should deliver. Having equity in your current house gives you a better opportunity to move-up or build your perfect home from scratch.

Mark Fleming, Chief Economist at First American, recently explained:

“As homeowners gain equity in their homes, they are more likely to consider using that equity to purchase a larger or more attractive home – the wealth effect of rising equity.”

If you need to make a move, the equity in your current home can help make that possible – right now.

2. Equity Enables Homeowners to Help Future Generations

An increase in home equity grows overall wealth, which can transfer to future generations. The Federal Reserve, in an addendum to their recent Survey of Consumer Finances, explains:

“There are numerous ways families can transmit wealth and resources across generations. Families can directly transfer their wealth to the next generation in the form of a bequest. They can also provide the next generation with inter vivos transfers (gifts), for example, providing down payment support to enable a home purchase or a substantial wedding gift.”

The Federal Reserve also explains another way wealth (including the additional net worth generated by an increase in home equity) can benefit future generations:

“In addition to direct transfers or gifts, families can make investments in their children that indirectly increase their wealth. For example, families can invest in their children's educational success by paying for college or private schools, which can in turn increase their children's ability to accumulate wealth.”

Bottom Line

Equity can help a homeowner grow their confidence in a more stable financial future. It provides near-term move-up options and creates a positive impact for future generations. In many cases, the largest single investment a person has is their home. As that investment appreciates in value, financial options increase too.

Friday, October 23, 2020

California Property Tax Scammers Going Door to Door

|

|

Friday, October 16, 2020

Reminding About Forbearance & Mortgage Relief During COVID

Do You Need to Know More about Forbearance

and Mortgage Relief Options?

Earlier this year when the nation pressed pause on the economy and unemployment rates jumped up significantly, many homeowners were immediately concerned about being able to pay their mortgages, and understandably so. To assist in this challenging time, two protection plans were put into place to help support those in need.

First, there was a pause placed on initiating foreclosures for government-backed loans. This plan started on March 18, 2020, and it extends at least through December 31, 2020. Second, homeowners were able to obtain forbearance for up to 180 days, followed by a potential extension for up to another 180 days. This way, there is a relief period in which homeowners have the opportunity to halt payments on their mortgages for up to one year.

Not Everyone Understands Their Options

The challenge, according to Matt Hulstein, Staff Attorney at non-profit Chicago Volunteer Legal Services, is, “A lot of homeowners aren’t aware of this option.”

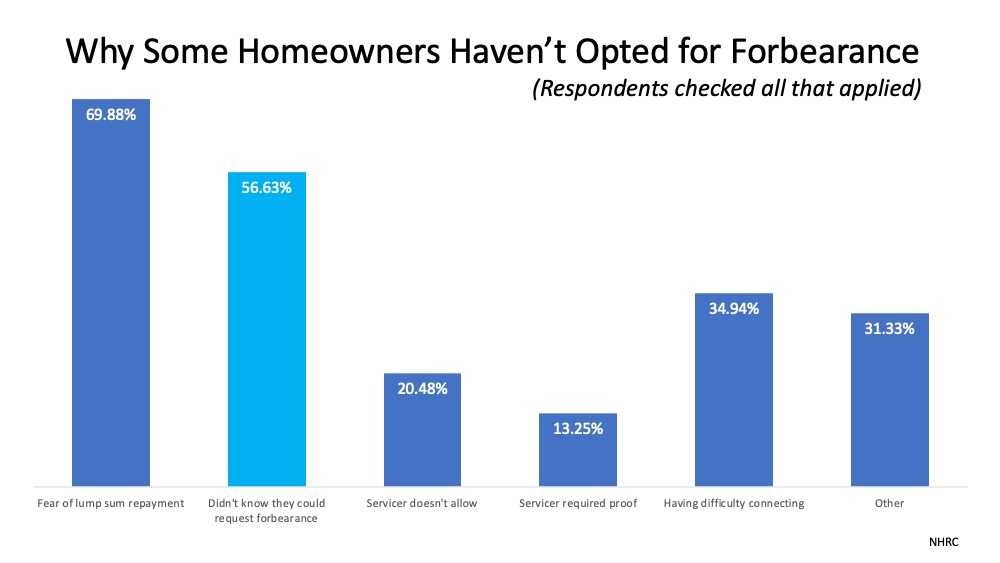

There’s definitely traction behind this statement. In a recent survey by The National Housing Resource Center, housing counselors from across the country noted that many homeowners really don’t know that there is help available. The following graph indicates the reasons why people who are in this challenging situation are not choosing to enter forbearance: The Urban Institute explained:

The Urban Institute explained:

“530,000 homeowners who became delinquent after the pandemic began did not take advantage of forbearance, despite being eligible to ask for the plan…These responses reflect a need to provide better information to all homeowners. (Lump-sum payment is not the only repayment option.)

Additionally, 205,000 homeowners who did not extend their forbearance after its term ended in June or July became delinquent on their loans. We need to examine who these people are and why are they not extending their option.”

Clearly, a more focused effort on education about forbearance and relief programs may make a big difference for many people, and a clear understanding of their options is mission-critical. Some communities, however, have been impacted by the economic challenges of the pandemic more so than others, further confirming the need to deliver education more widely. The Urban Institute also indicates:

“Black and Hispanic homeowners have been hit harder than white homeowners…nearly 21 percent of both Black and Hispanic homeowners missed or deferred the previous month’s mortgage payment, compared with 10 percent of white homeowners and about 13 percent of all homeowners with payments due.”

Options Available

It’s important to note that any homeowner experiencing financial hardship has the right to request forbearance. If you’re unfamiliar with the plans available, contact your mortgage provider (the company you send your mortgage payment to each month) to discuss your options. It is a necessary next step, as you may qualify for mortgage relief options or forbearance.

One option many homeowners may not realize they have is the ability to sell their house in this time of need. With the growing equity that homeowners have available today, making a move might be the best option to protect your financial future.

Bottom Line

If you need additional information on your options, you can review the Protect Your Investment guide from the National Association of Realtors (NAR) and the Homeowner’s Guide to Success from the Consumer Financial Protection Bureau (CFPB). For the majority of people, our home is the most important asset we have, and you should use all the help available right now to be able to preserve your investment.

Tuesday, October 13, 2020

If You're Wondering About Buying Your Retirement Home Now.......Read On!

Should You Buy a Retirement Home Sooner Rather than Later?

Every day in the U.S., roughly 10,000 people turn 65. Prior to the health crisis that swept the nation in 2020, most people had to wait until they retired to make a move to the beach, the golf course, or the senior living community they were looking to settle into for their later years in life. This year, however, the game changed.

Many of today’s workers who are nearing the end of their professional careers, but maybe aren’t quite ready to retire, have a new choice to make: should I move before I retire? If the sand and sun are calling your name and you have the opportunity to work remotely for the foreseeable future, now may be a great time to purchase that beach bungalow you’ve always dreamed of or the single-story home in the sprawling countryside that might be a little further out of town. Whether it’s a second home or a future retirement home, spending the next few years in a place that truly makes you smile every day might be the best way to round out a long and meaningful career.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“The pandemic was unexpected, working from home was unexpected, but nonetheless many companies realized that workers can be just as productive working from home…We may begin to see a boost in people buying retirement homes before their retirement.”

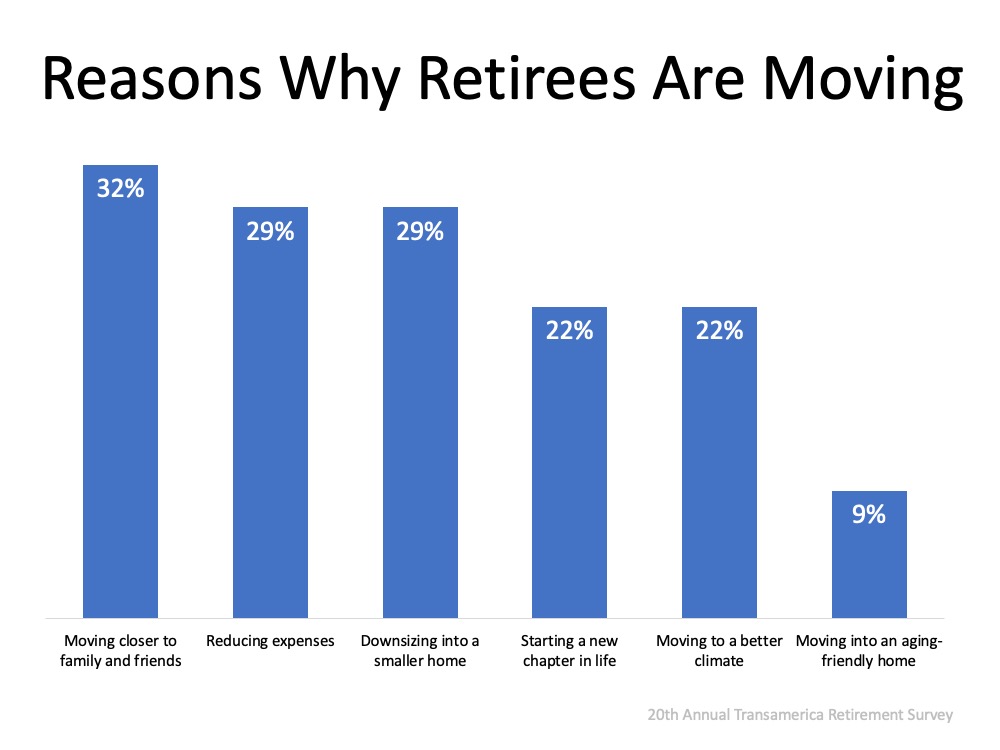

According to the 20th Annual Transamerica Retirement Survey, 3 out of 4 retirees (75%) own their homes, and only 23% have mortgage debt (including any equity loans or lines of credit). Since entering retirement, almost 4 in 10 retirees (38%) have moved into a new home. They’re making a profit by selling their current homes in today’s low inventory market and using their equity to purchase their future retirement homes. It’s a win-win.

Why These Homeowners Are Making Moves Now

The health crisis this year made us all more aware of the importance of our family and friends, and many of us have not seen our extended families since the pandemic started. It’s no surprise, therefore, to see in the same report that 32% of those surveyed cited the top reason they’re making a move is that they want to be closer to family and friends (See graph below): The survey also revealed that 73% percent of retirees currently live in single-family homes. With the overall number of homes for sale today hitting a historic low, and with the buyer demand for single-family homes skyrocketing, there’s never been a more ideal time to sell a single-family home and make a move toward retirement. Today’s market has the perfect combination of driving forces to make selling optimal, especially while buyers are looking to take advantage of low interest rates.

The survey also revealed that 73% percent of retirees currently live in single-family homes. With the overall number of homes for sale today hitting a historic low, and with the buyer demand for single-family homes skyrocketing, there’s never been a more ideal time to sell a single-family home and make a move toward retirement. Today’s market has the perfect combination of driving forces to make selling optimal, especially while buyers are looking to take advantage of low interest rates.

If you’re one of the 73% of retirees with a single-family home and want to move closer to your family, now is the time to put your house on the market. With the pace homes are selling today, you could essentially wrap up your move – start to finish – before the holidays.

Bottom Line

Whether you’re looking to fully retire or to buy a second home with the intent to use it as your retirement home in the future, the 2020 fall housing market may very well work in your favor. Let’s connect today to discuss your options in our local market.