|

This blog is set up for clients, associates, friends, relatives, and myself, to discuss real estate thoughts, questions and get some answers.

Tuesday, June 30, 2020

Still Blown Away By Interest Rates!

Friday, June 26, 2020

Yay! Another New Form.....That is Absurdly Unnecessary....IMHO.

Come on already!!! Yes, we have gotten a ton of new forms due to the Corona Virus Pandemic. Most have been revamped numerous times. And, we'll likely see them revamped a few more.

But, this newest one? You've got to be kidding me? Doesn't everyone know about ALL of these things before they go house hunting?

But, this newest one? You've got to be kidding me? Doesn't everyone know about ALL of these things before they go house hunting?

Common sense seems to be forgotten if we have to use this form, and my company is requiring it starting July 1st! Common sense for the buyers, the Realtors showing their buyers, agents hosting open houses....what's that the kids say? Cray-Cray!

The first paragraph is the most important one that every agent should regularly remind buyers about. Mostly because if you mention how much you love a home "and would pay anything to get it" & it's picked up on the Sellers security system because they forgot to tell us there was one.....all negotiations go out the window!

The rest? Common Sense People! LOLOLOL

Tuesday, June 23, 2020

So Many Different Thoughts About Housing!

I read this today and almost spit my coffee out. Funny how different people feel about the housing market. Read through and notice they are only talking about 2020. No one wants to even begin to suggest what will happen in 2021. Feel free to ask my opinion. I'm open, honest to a fault, and will tell you what my experience, and watching the market, is telling me about next year & beyond.

-----------------------------------------------

What Are the Experts Saying About Future Home Prices?

A worldwide pandemic and an economic recession have had a tremendous effect on the nation. The uncertainty brought about by both has made predicting consumer behavior nearly impossible. For that reason, forecasting home prices has become extremely difficult.

Normally, there’s a simple formula to determine the future price of any item: calculate the supply of that item in ratio to the demand for that item. In housing right now, demand far exceeds supply. Mortgage applications to buy a home just rose to the highest level in 11 years while inventory of homes for sale is at (or near) an all-time low. That would usually indicate strong appreciation for home values as we move throughout the year.

Some experts, however, are not convinced the current rush of purchasers is sustainable. Ralph McLaughlin, Chief Economist at Haus, explained in their June 2020 Hausing Market Forecast why there is concern:

“The upswing that we’ll see this summer is a result of pent-up demand from homebuyers and supply-in-progress from homebuilders that has simply been pushed off a few months. However, after this pent-up demand goes away, the true economic scarring due to the pandemic will begin to affect the housing market as the tide of pent-up demand goes out.”

The virus and other challenges currently impacting the industry have created a wide range of thoughts regarding the future of home prices. Here’s a list of analysts and their projections, from the lowest depreciation to the highest appreciation:

- CoreLogic: Year-Over-Year decline of -1.5%

- Haus: Year-Over-Year decline of -1%

- Zillow: Year-Over-Year change is forecasted to bottom out at -0.7%.

- Home Price Expectation Survey: Decline of -0.3% in 2020

- Fannie Mae: Increase of 0.4% in 2020

- Freddie Mac: Increase of 2.3% in 2020

- Zelman & Associates: Increase of 3.0% in 2020

- National Association of Realtors: Increase of 3.8% in 2020

- Mortgage Bankers Association: Increase of 4.0% in 2020

We can garner two important points from this list:

- There is no real consensus among the experts.

- No one projects prices to crash like they did in 2008.

Bottom Line

Whether you’re thinking of buying a home or selling your house, know that home prices will not change dramatically this year, even with all of the uncertainty we’ve faced in 2020.

Friday, June 19, 2020

Home Sales In Santa Clarita Valley June 19, 2010

Today is an important day, I just hope everyone knows why, and realizes how important it is. Oh my, a somewhat political statement from me!

On to home sales though.....

In my sweet Santa Clarita Valley, and our fantabulous surrounding communities, we currently only have 384 active listings. Shocking as I just saw 27 new listings hit the market yesterday!

On to home sales though.....

In my sweet Santa Clarita Valley, and our fantabulous surrounding communities, we currently only have 384 active listings. Shocking as I just saw 27 new listings hit the market yesterday!

I love Giraffes!

But, the shock reduces when I calculate the number of homes in escrow....586...Yup, that's a really nice hefty number of people that have agreed to sell/buy a home.

In the last 30 days we've closed escrows on 277 properties in SCV. That's about 100 more than the month before.

Buyers are out in full force right now, I mean, really pounding the pavement! Sellers that were waiting are putting their homes on the market. Interest rates are crazy low.....so, dang, I've got 3 in escrow and a new listing just hit yesterday that has had a revolving door of showings!

I'm around for all your questions about home selling and buying. Even if you're just thinking about it a year from now. I love providing people with knowledge. It's free to give information!

~ Lauren Witz Greber ~ Lauren@KeepYourWitz.com ~

~ www.KeepYourWitz.com ~ (661) 313-5470 ~

Tuesday, June 16, 2020

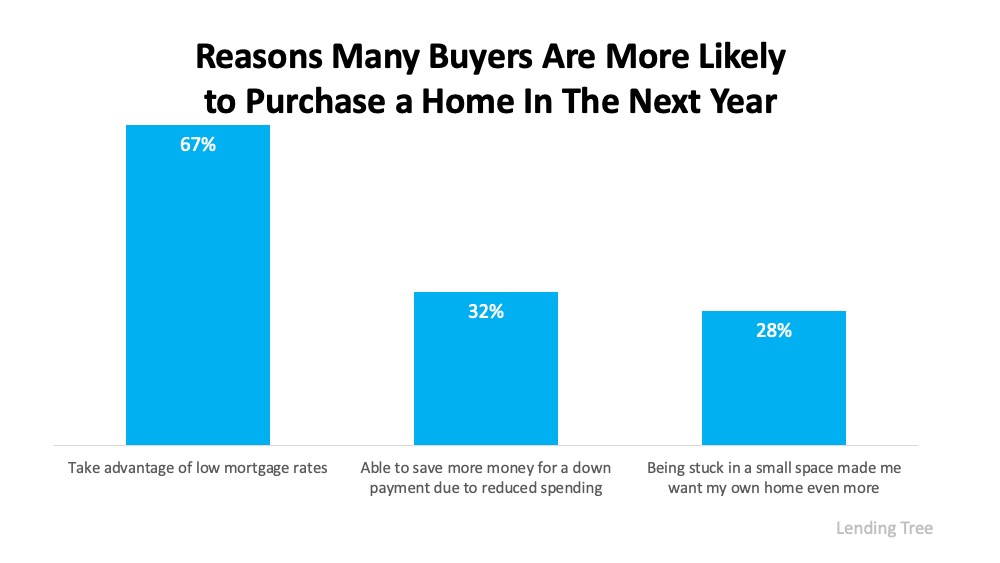

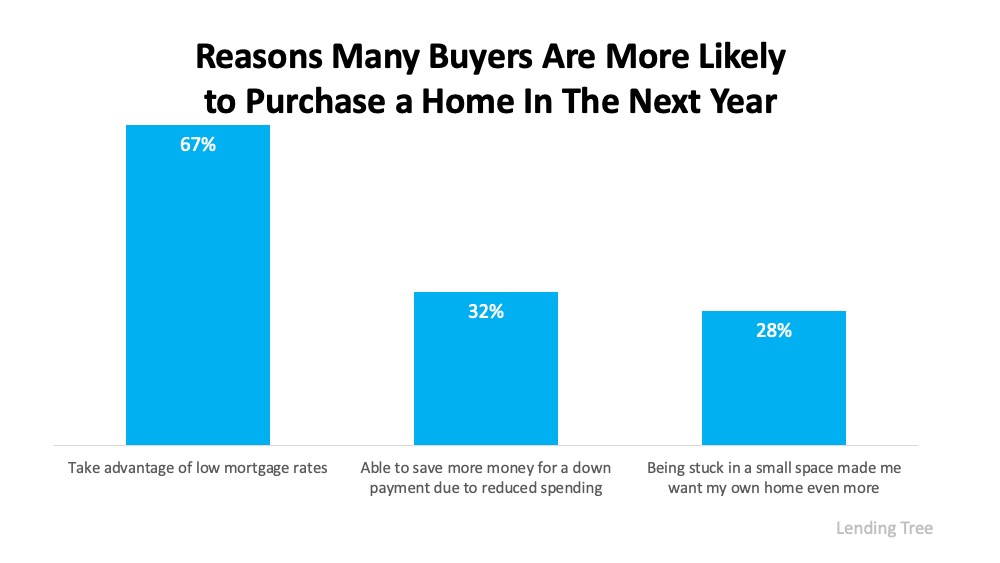

I think Reason # 1 and # 3 Are the Biggies!

Three Reasons Home Buyers Are Ready to Purchase This Year

A recent survey by Lending Tree tapped into behaviors of over 1,000 prospective buyers. The results indicated 53% of all homebuyers are more likely to buy a home in the next year, even amid the current health crisis. The survey further revealed why, naming several reasons buyers are more likely to move this year (see graph below): Let’s break down why these are a few of the key factors motivating buyers to actively engage in the home search process, and the corresponding wins for sellers as well.

Let’s break down why these are a few of the key factors motivating buyers to actively engage in the home search process, and the corresponding wins for sellers as well.

Let’s break down why these are a few of the key factors motivating buyers to actively engage in the home search process, and the corresponding wins for sellers as well.

Let’s break down why these are a few of the key factors motivating buyers to actively engage in the home search process, and the corresponding wins for sellers as well.

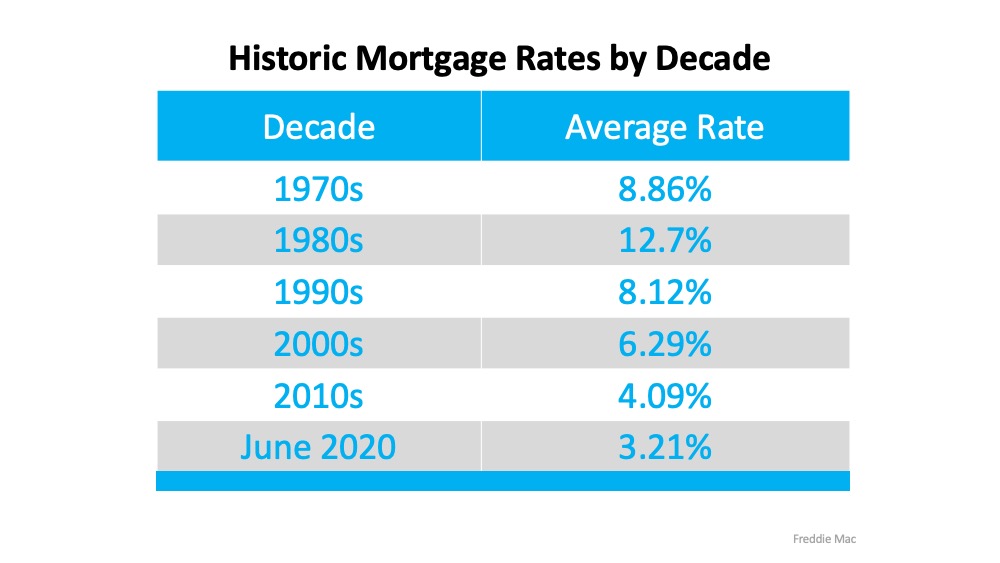

1. Low Mortgage Rates

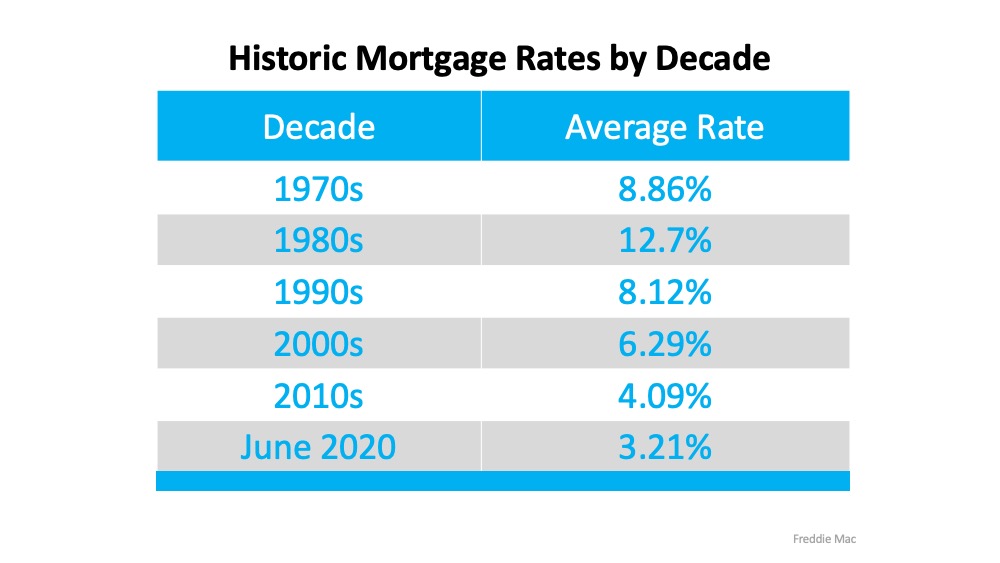

The biggest reason potential homebuyers indicated they’re eager to purchase this year is due to current mortgage rates, which are hovering near all-time lows. Today’s low rates are making it more affordable than ever to buy a home, which is a huge incentive for purchasers. In fact, 67% of respondents in the Lending Tree survey want to take advantage of low mortgage rates. This is no surprise when comparing historic mortgage rates by decade (see below): Sam Khater, Chief Economist at Freddie Mac recently said:

Sam Khater, Chief Economist at Freddie Mac recently said:

Sam Khater, Chief Economist at Freddie Mac recently said:

Sam Khater, Chief Economist at Freddie Mac recently said:“As the economy is slowly rebounding, all signs continue to point to a solid recovery in home sales activity heading into the summer as prospective buyers jump back into the market. Low mortgage rates are a key factor in this recovery.”

2. Reduced Spending

Some people have also been able to save a little extra money over the past few months while sheltering in place. One of the upsides of staying home recently is that many have been able to work remotely and minimize extra spending on things like commuting expenses, social events, and more. For those who fall into this category, they may have a bit more saved up for down payments and closing costs, making purchasing a home more feasible today.

3. Re-Evaluating Their Space

Spending time at home has also given buyers a chance to really evaluate their living space, whether renting or as a current homeowner. With time available to craft a wish list of what they really need in their next home, from more square footage to a more spacious neighborhood, they’re ready to make it happen.

What does this mean for buyers and sellers?

With these three factors in play, the demand for housing will keep growing this year, especially over the summer as more communities continue their phased approach to reopening. Buyers can take advantage of additional savings and low mortgage rates. And if you’re thinking of selling, know that your home may be in high demand as buyer interest grows and the number of homes for sale continues to dwindle. This may be your moment to list your house and make a move into a new space as well.

Bottom Line

If you’re ready to buy or sell – or maybe both – let’s connect to put your plans in motion. With low mortgage rates leading the way, it’s a great time to take advantage of your position in today’s market.

Friday, June 12, 2020

So, Let's Just Go Ahead And Talk About Lender Pre-Approvals

There is an old thing called a pre-qualification....and a term we've used as well called a pre-approval.

This, I presume you know, is related to a lender saying you can get a loan to buy a home.

But, there are significant differences between those two terms.

I could just put the picture up and stop writing, but it's important to know why the pre-qualification has gone away for us Realtors.

Why? Because it doesn't mean anything to us, the ones that are hired by people to sell their home.

Without a lender looking at your credit report, your tax returns, your income verification, bank statements, W-2's, etc......you just giving them numbers is only the beginning. Only a pre-qual. It only tells you, the buyer, what you may feel comfortable spending.

It does not tell a lender, that you're hoping to borrow a large sum of money from, if you truly will pay it back. If the risk they are taking is worth it. Yes, lend someone a 1/2 million dollars or more, that's a risk for sure.

So, when you're looking to buy a home, you must get a full documentation pre-approval. Too many things that a buyer may have forgotten, doesn't know matter, didn't realize it was on their credit report. Or maybe the words the lender they talked to about a pre-qual, didn't quite make sense, and they didn't think the co-borrowing they did for their sister last year that she defaulted on was important.

Lordy, that stuff is sooooo important. And, with over 50% of Sellers requiring a pre-approval just to view their home during Corona Virus? Yup, get the right 'PRE', not the qualification, the approval.

Fab Friday to you!

This, I presume you know, is related to a lender saying you can get a loan to buy a home.

But, there are significant differences between those two terms.

Why? Because it doesn't mean anything to us, the ones that are hired by people to sell their home.

Without a lender looking at your credit report, your tax returns, your income verification, bank statements, W-2's, etc......you just giving them numbers is only the beginning. Only a pre-qual. It only tells you, the buyer, what you may feel comfortable spending.

It does not tell a lender, that you're hoping to borrow a large sum of money from, if you truly will pay it back. If the risk they are taking is worth it. Yes, lend someone a 1/2 million dollars or more, that's a risk for sure.

So, when you're looking to buy a home, you must get a full documentation pre-approval. Too many things that a buyer may have forgotten, doesn't know matter, didn't realize it was on their credit report. Or maybe the words the lender they talked to about a pre-qual, didn't quite make sense, and they didn't think the co-borrowing they did for their sister last year that she defaulted on was important.

Lordy, that stuff is sooooo important. And, with over 50% of Sellers requiring a pre-approval just to view their home during Corona Virus? Yup, get the right 'PRE', not the qualification, the approval.

Fab Friday to you!

Tuesday, June 9, 2020

Real Estate Stories During a Pandemic

Because, yet again, another story about Pandemic rules not being followed...

I wish I could keep up 100% with all of them, I think I'm about 99% because old habits die hard. And, they keep changing our rules. I'm doing my best.

I wish I could keep up 100% with all of them, I think I'm about 99% because old habits die hard. And, they keep changing our rules. I'm doing my best.

Last week, a buyer was doing their home inspection in one of my listings. They signed a document indicating that they would be wearing masks, gloves, not touch anything. We know the home inspector had to touch things of course, hopefully he was wearing gloves.....

My Sellers came in and found the buyers crew, one that wasn't even supposed to be there, sitting on their couch with no gloves or mask on while doing the inspector recap. Eeeeeck.

This morning I went to show a property to a buyer. I have gloves, mask, sanitizer in my car at all times. She forgot her gloves, so there goes another pair for one of my peeps. The newest Best Practices indicates that masks, hand sanitizer and sanitizing wipes must be available. All agents, like me, should have them available for their clients, but ultimately it's the listing agents responsibility. And, the home is supposed to be cleaned in between appointments. All areas that may have been touched by a previous person viewing home.

As we were heading upstairs...lo & behold....in came another agent. We were scheduled at 11. She was there about 11:08. Certainly no cleaning in between showings happening there. She did wait outside until we were done. Oh, crap, I just realized I didn't sanitize the keys when I put them back in the lockbox...but, I was wearing a brand new pair of gloves.....sheesh.

I could go on & on & on about the rules not being adhered to. I warned my sellers, the ones that got their couches sat on, that they needed to be prepared for lack of rule following. They would definitely need to plan on wiping everything down after a showing.

I was texting with one of our managers about the latest ....they suggested we start a blog called Realtor Covidiots! Funny, but really shouldn't be.

The problem herein? Not All Realtors Are Great. Sound familiar? So, I do my best, my absolute best with any given circumstances. Because, Not All People Are Great Either.....nope, that's an impossibility indeed.

Friday, June 5, 2020

Two Hours to Cook - 20 Minutes to Eat! Maybe We'd Stay Longer in Prettier Dining Rooms?

Okay, so you all know by now that I read stuff that Houzz sends me. I share what I find appealing and interesting. Well, maybe that's kinda biased, but, heck, this is my blog after all! 😄

This morning I perused through some of my Houzz emails and read a few articles and the whole thing about the dining room reminded me of holidays where I slave away for the day, or hours at least, then it takes 20 minutes to eat and ....poof.....everyone leaves the dining room! Right? I laugh, my husband goes crazy when I say...Ah, Right?

At any rate, I decided to share that Houzz article and a couple images I found that are pretty darn remarkable for your reading pleasure!

Houzz article here: Houzz 2020 Popular Dining Rooms

I'm quite sure you'll find something you like in the article!

But, these caught my eye:

I gotta tell you, the 2nd one is a bit to WOW for me but those chairs look pretty dang comfy! The first one....LOVE, love, love the wood beam accents.....but that wallpaper? Not so sure. Funniest thing is I put up some super cute wallpaper in my old house in West Los Angeles. And, I've seen some gorgeous wallpaper with ginormous pink flowers that I love as well.

But, to each his own. Take a gander at the article....lemme know your thoughts!

Tuesday, June 2, 2020

EIGHTEEN Years!!!

I am amazed how much time has gone by since I first earned my Real Estate license!!

This morning, one of my past clients wished my Happy Anniversary via LinkedIn. I had completely not even thought about June being my anniversary month.

I've been through a lot as a local Realtor. A lot of different types of markets. Sellers market, Buyers market, Short-Sales, Foreclosures....and, now a Pandemic!

And, I've worked with a lot of different clients over those 18 years. Just yesterday I was with buyers during an inspection for a home they are in escrow on. We talked about my honesty, then mentioned that I was a little challenging at first. They thought I was trying to tell them what they should & shouldn't like. Then, they realized I was just telling them every single piece of information I had gleaned after 18 years of buying and selling homes! They actually said they had never really trusted a Realtor until they met me. I choked up a bit on that one. Now, they tease me and say I'm part of the family. They must have a crazy family, right? LOLOL

I still remember one of my associate agents telling me I inform my clients of too much. Another telling me I show too many properties to one buyer. Others probably looking at me in shock as I pointed out flaws in a property well before a home inspection.

Allllll of my clients deserve to know what I know. That's why they hire a Realtor, because we know more than them.

I admit, some have to get used to my 'shoot-from-the-hip' honesty. But, the ones that do....and, most of them definitely do....they have always told me how much they appreciate my 100% truthfulness when working with them.

This morning, one of my past clients wished my Happy Anniversary via LinkedIn. I had completely not even thought about June being my anniversary month.

I've been through a lot as a local Realtor. A lot of different types of markets. Sellers market, Buyers market, Short-Sales, Foreclosures....and, now a Pandemic!

And, I've worked with a lot of different clients over those 18 years. Just yesterday I was with buyers during an inspection for a home they are in escrow on. We talked about my honesty, then mentioned that I was a little challenging at first. They thought I was trying to tell them what they should & shouldn't like. Then, they realized I was just telling them every single piece of information I had gleaned after 18 years of buying and selling homes! They actually said they had never really trusted a Realtor until they met me. I choked up a bit on that one. Now, they tease me and say I'm part of the family. They must have a crazy family, right? LOLOL

I still remember one of my associate agents telling me I inform my clients of too much. Another telling me I show too many properties to one buyer. Others probably looking at me in shock as I pointed out flaws in a property well before a home inspection.

Allllll of my clients deserve to know what I know. That's why they hire a Realtor, because we know more than them.

I admit, some have to get used to my 'shoot-from-the-hip' honesty. But, the ones that do....and, most of them definitely do....they have always told me how much they appreciate my 100% truthfulness when working with them.

So, to my peeps? I thank you for putting up with me. For trusting me.

For letting me help you for these last 18 years!

Cheers & Happy Anniversary to Me!

Subscribe to:

Posts (Atom)