Earlier this year when the nation pressed pause on the economy and unemployment rates jumped up significantly, many homeowners were immediately concerned about being able to pay their mortgages, and understandably so. To assist in this challenging time, two protection plans were put into place to help support those in need.

First, there was a pause placed on initiating foreclosures for government-backed loans. This plan started on March 18, 2020, and it extends at least through December 31, 2020. Second, homeowners were able to obtain forbearance for up to 180 days, followed by a potential extension for up to another 180 days. This way, there is a relief period in which homeowners have the opportunity to halt payments on their mortgages for up to one year.

Not Everyone Understands Their Options

The challenge, according to Matt Hulstein, Staff Attorney at non-profit Chicago Volunteer Legal Services, is, “A lot of homeowners aren’t aware of this option.”

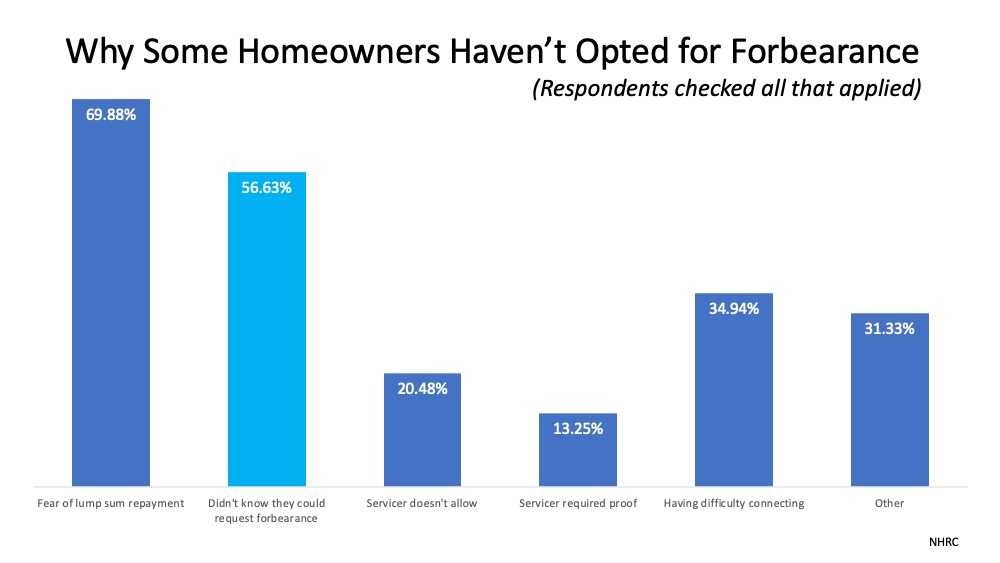

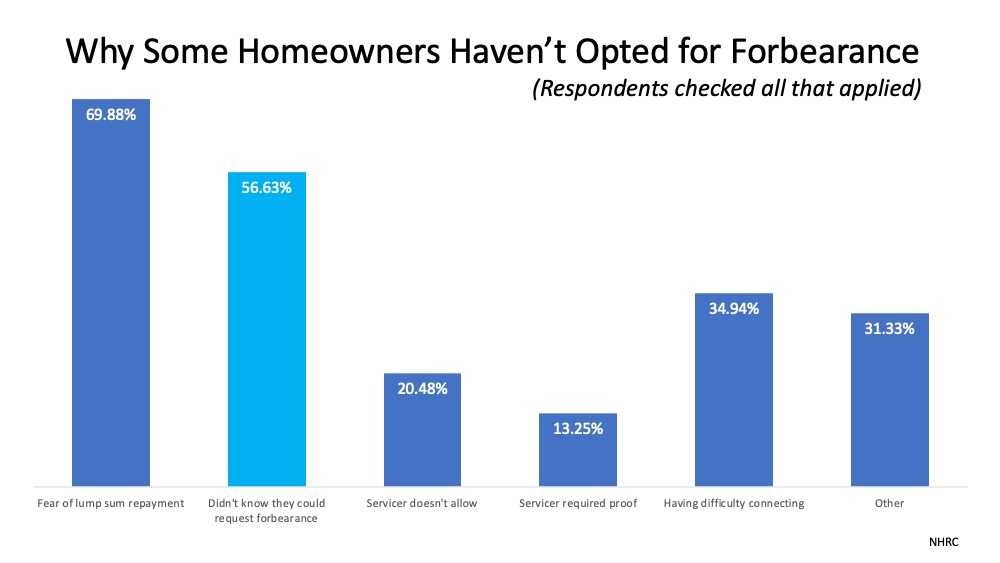

There’s definitely traction behind this statement. In a recent survey by The National Housing Resource Center, housing counselors from across the country noted that many homeowners really don’t know that there is help available. The following graph indicates the reasons why people who are in this challenging situation are not choosing to enter forbearance: The Urban Institute explained:

The Urban Institute explained:

“530,000 homeowners who became delinquent after the pandemic began did not take advantage of forbearance, despite being eligible to ask for the plan…These responses reflect a need to provide better information to all homeowners. (Lump-sum payment is not the only repayment option.)

Additionally, 205,000 homeowners who did not extend their forbearance after its term ended in June or July became delinquent on their loans. We need to examine who these people are and why are they not extending their option.”

Clearly, a more focused effort on education about forbearance and relief programs may make a big difference for many people, and a clear understanding of their options is mission-critical. Some communities, however, have been impacted by the economic challenges of the pandemic more so than others, further confirming the need to deliver education more widely. The Urban Institute also indicates:

“Black and Hispanic homeowners have been hit harder than white homeowners…nearly 21 percent of both Black and Hispanic homeowners missed or deferred the previous month’s mortgage payment, compared with 10 percent of white homeowners and about 13 percent of all homeowners with payments due.”

Options Available

It’s important to note that any homeowner experiencing financial hardship has the right to request forbearance. If you’re unfamiliar with the plans available, contact your mortgage provider (the company you send your mortgage payment to each month) to discuss your options. It is a necessary next step, as you may qualify for mortgage relief options or forbearance.

One option many homeowners may not realize they have is the ability to sell their house in this time of need. With the growing equity that homeowners have available today, making a move might be the best option to protect your financial future.

Bottom Line

If you need additional information on your options, you can review the Protect Your Investment guide from the National Association of Realtors (NAR) and the Homeowner’s Guide to Success from the Consumer Financial Protection Bureau (CFPB). For the majority of people, our home is the most important asset we have, and you should use all the help available right now to be able to preserve your investment.

![Should I Renovate My House Before I Sell It? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/10/29115125/20201030-MEM-1046x1807.png)